PAYMENT PROCESSING

That Reaches Your Customers

No Matter Where They Are

PAYMENT SOLUTIONS FOR ALL OF YOUR NEEDS

WELCOME TO ENVISION PAYMENTS

Our secure, intelligent payment solutions work for any business. We have the flexibility to create a product that meets your requirements because we developed and own our proprietary customizable software. We combine our knowledge of payment processing with what we learn from you about your business to recommend the best solution to build, track, and protect your revenue.

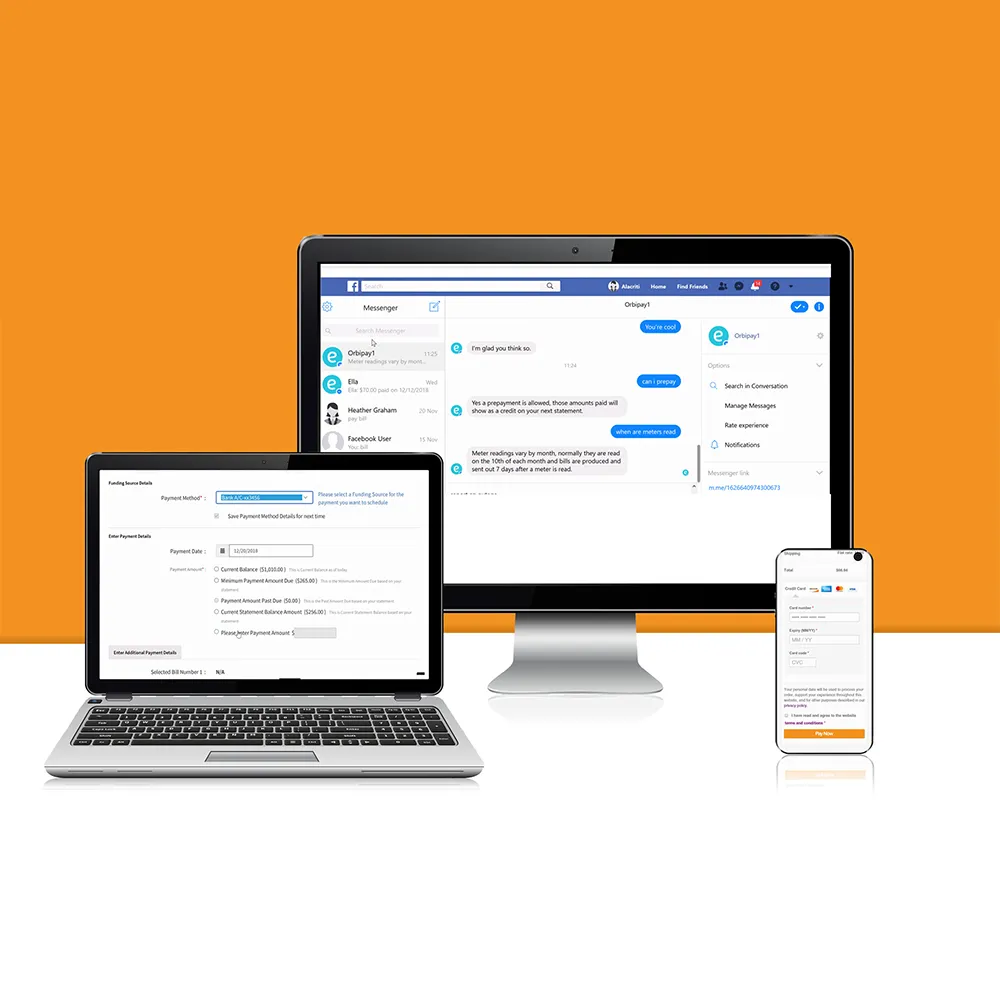

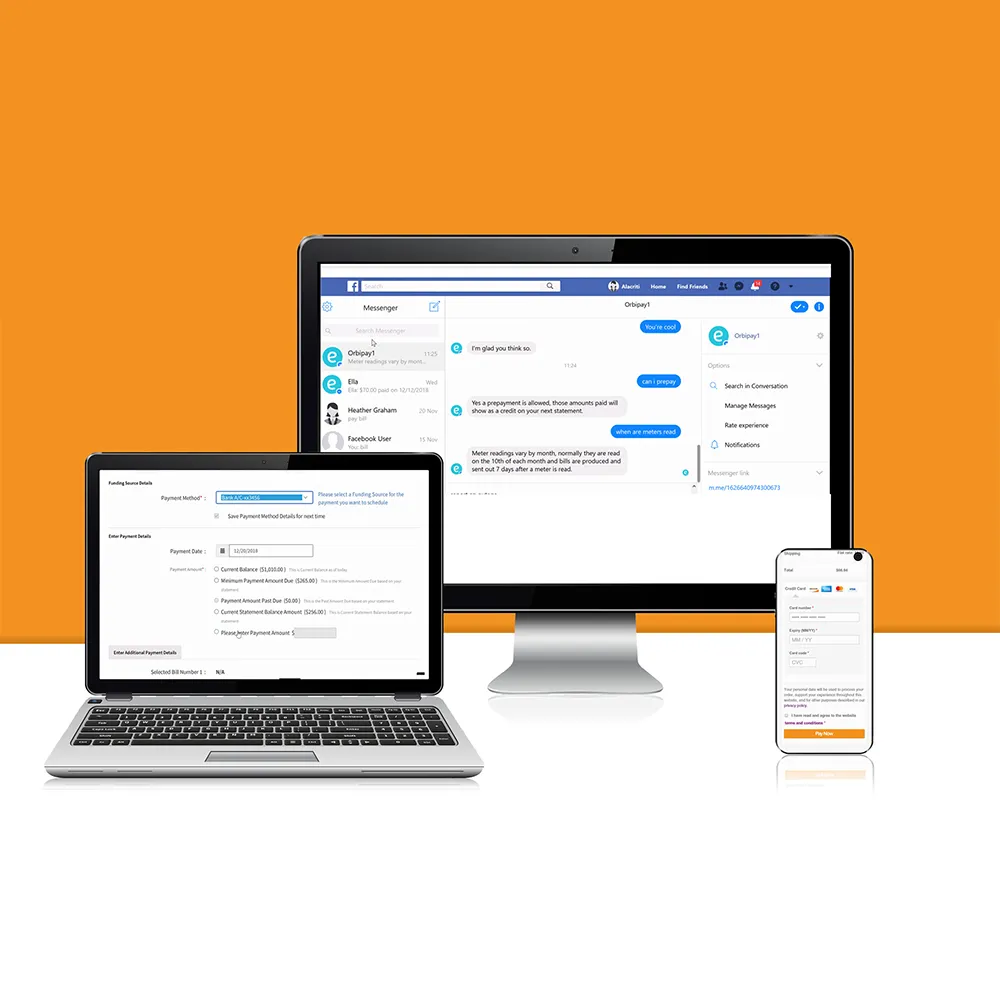

Ella Chatbot - The Future of Payment Processing

Online payments have never been easier with the help of artificial intelligence. Ella chatbot allows customers to ask questions and make payments over Facebook Messenger. Set up Ella Chatbot today to make the payment process more streamlined than ever before.

TONS OF PAYMENT SOLUTIONS

The payment landscape is changing and your customers desire payment flexibility. To meet this demand, consider providing multiple payment options across all sales channels and devices.

Let’s consider an example. A hypothetical restaurant has a brick-and-mortar restaurant, online ordering, and large-scale catering orders. Each of these different options requires its own individual payment experience. If the restaurant is catering to a large party, it would be inconvenient to make the customer go to the physical restaurant to pay off an invoice when it would be easier to pay online. Expanding your payment processing capabilities across multiple platforms is a great way to adapt to the needs of your customers. Keep in mind that the payment experience should remain consistent across all verticals. According to Crowdspring, “90% of consumers expect their experience with a brand to be similar across all platforms and devices.” Whether it be online, mobile, telephone, ACH, or point of sale, it’s important to offer a variety of different payment platforms to give your customers the type of payment experience they desire.

TONS OF PAYMENT SOLUTIONS

The payment landscape is changing and your customers desire payment flexibility. To meet this demand, consider providing multiple payment options across all sales channels and devices.

Let’s consider an example. A hypothetical restaurant has a brick-and-mortar restaurant, online ordering, and large-scale catering orders. Each of these different options requires its own individual payment experience. If the restaurant is catering to a large party, it would be inconvenient to make the customer go to the physical restaurant to pay off an invoice when it would be easier to pay online. Expanding your payment processing capabilities across multiple platforms is a great way to adapt to the needs of your customers. Keep in mind that the payment experience should remain consistent across all verticals. According to Crowdspring, “90% of consumers expect their experience with a brand to be similar across all platforms and devices.” Whether it be online, mobile, telephone, ACH, or point of sale, it’s important to offer a variety of different payment platforms to give your customers the type of payment experience they desire.

MAXIMIZED PAYMENT SECURITY

According to ACI Worldwide, 46% of Americans have been victims of credit card fraud in the past 5 years.

When customers provide you with their payment information, they are trusting that you will keep their sensitive data safe. Fortunately, there are measures you can take to help protect your customers from fraud. Use credit card tokenization on all transactions. Tokenization is an advanced data security method that protects sensitive credit card data at each stage of the transaction process. Tokenization replaces credit card information with an indecipherable code that keeps data safe from fraud. Make sure to use a payment gateway that stores sensitive credit card information off-site on PCI-compliant servers. This eliminates security risks and liabilities for your business and ensures that customer information is being protected at all times. Additionally, it’s important to utilize a payment gateway that submits line-item details to the point of sale when processing credit cards. This extra layer of information helps better identify a customer’s identity, significantly reducing liability if fraud occurs.

FULL PAYMENTS SYSTEM INTEGRATIONS

Your customers expect a seamless and secure payment experience. Payment integration can give your business more ways to enhance the customer experience and ensure that payments are processed quickly and securely.

Without payment integration, your customers can easily lose trust in your business. If they have to navigate to a separate site to pay, they may question the security of the payment experience or they may get frustrated and leave your site altogether. Integrating your payments can keep your customers happy with a seamless payment experience from start to finish. Maximizing your customer payment experience will help bring in new clients and retain existing customers. If your payment experience is easy, customers will remember your business for future purchases. Ensuring that your payment process is focused on providing an excellent customer experience will help foster trust and build confidence in your brand.